- Home

- About Us

Learn More About Us

We have capacity to assist with individuals or businesses accounting, tax and business advice.

- Services

Learn More About Our SERVICES

We have capacity to assist with individuals or businesses accounting, tax and business advice.

- Specialist Services

Learn More

We have capacity to assist with individuals or businesses accounting, tax and business advice.

- WHO WE HELP

Learn More

We have capacity to assist with individuals or businesses accounting, tax and business advice.

- Cloud Accounting

Learn More

We have capacity to assist with individuals or businesses accounting, tax and business advice.

- Resources

Learn More

We have capacity to assist with individuals or businesses accounting, tax and business advice.

- CLIENT ZONE

Learn More

We have capacity to assist with individuals or businesses accounting, tax and business advice.

- Contact us

Fix Fee Pricing

Contact Oxbridge Accountants & Tax Advisors Call our friendly team on 0203 442 1900

Fixed Fee Pricing

Oxbridge Accountants and Tax Advisors (OATA) operates a fixed fee system, to ensure that our customers have peace of mind that no hidden fees will be added during the use of our services. Our accountants will meet with each customer to assess what accountancy, tax and/or business advice and extent of work that needs to be carried out. Equally, we will discuss the possible tax savings available, and answer any questions you may have.

Initial Consultation

During the initial meetings, we will discuss with you a fee proposal which will cover the fees we charge for the services you are interested in. Prices are determined by the accountant based on a number of factors, one of which is the perceived value of the service. We keep our pricing clear and fixed so that you know what our fees will be each year. This process is to assure you that there would be no nasty hidden fees, so you do not have to worry about receiving an unpleasant and unexpected bill at the end of the line. We offer flexible payment options which allow our clients to pay their fixed accountancy, business advice and tax fees in easy to manage instalments by monthly Direct Debit, which can really help with cashflow and most of our clients prefer this option. If it’s a one-off service then we can offer card payment services or bank transfer to make this easier. Even though there is no obligation to use our accountancy services, once you’ve met with us, our quote will be valid for up to three months to give you plenty of time to think about the meeting and ask any further questions before you decide.

For complicated cases we may consider charging fees on an individual basis. Once you have become a client and should you need to add more services then we will produce a new proposal to include the new pricing. Everything will be agreed in advance with you so there will be no nasty surprises

Ways To Contact Us

Get in touch

Call us on 03333055773 to arrange free consultation by phone

Discuss online

You can have free accountancy consultation via video

Visit us

May pop into our local offices for a meeting in person

Why Fixed Pricing?

Both accountants and their clients benefit from fixed fee pricing. Fixed pricing shifts the focus of your relationship from the number of hours spent on your services to the progress that’s made and the value that’s added. Some of the fixed pricing benefits that clients will experience include:

- Better service at a similar cost

- Recurring services delivered at a higher standard

- Increased confidence in their accountant as a trusted advisor

- The ability to provide more efficient services with higher profits

- Decreased concern for billable hours

- The ability to scale their practice

In the end, fixed pricing helps to deepen trust within the client-vendor relationship from transactional to strategic.

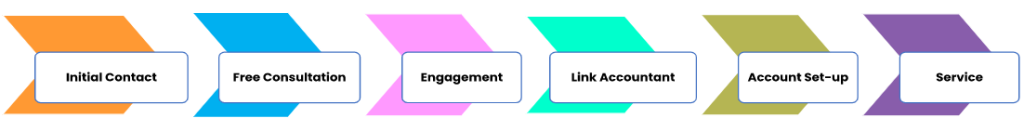

Service Pathway

Our Approach

Our professional accountants, business and tax consultants can employ a wide variety of diagnostic tools to explore and provide the expert support you need. Investing in and receiving the right support and advice right at the start will make life a lot easier in the years to come; allowing you to grow your business. At Oxbridge Accountants, we can support you by undertaking all of the important background work and the information we need to help you make informed decisions and gain the confidence you need to focus on establishing your new enterprise. Oxbridge Accountants and Tax Advisors are experts in supporting individuals, start-ups, established businesses, private and public corporations – working in close partnership to ensure growth and becoming successful, profit-making organisations. Besides undertaking the obligatory computations on payroll, self-assessment returns, invoicing and completing your return, you will benefit from our advisory services so you can minimise your tax liability. In case of any tax issue that arises with HMRC, Oxbridge Accountants and Tax Advisors will directly deal with HMRC on your behalf.

Your Decision

Should you decide to take us on board, you can be rest assured that you will be working with accountants, business and tax advisors who are pioneers in the field. We use cutting edge accounting and tax systems – including online web applications, mobile apps – which makes us more efficient than other accountancy firms. Our services are tailored to deliver affordable and faultlessly efficient, comprehensive online services (using a range of software compatible with our clients’), which our customers can rely upon completely.

Contact Us

0203 442 1900

Steps To Join Us

1.Contact us

Get in touch today via telephone, email text or inline to speak to the finest and highly competent accountants about your needs and agree how best we can assist you to be compliant and savings.

2.Free Consultations

We offer free consultations with all initial meetings. It is always useful to speak to us because we will try and make complex issues simple to give you peace of mind. Often you will find that no taxes are due.

3.Fixed Quote

We offer reasonable charges for the best accounting, tax and business advice you can get. There are no hidden charges. You pay for the level of support you receives. All quotes are agreed upfront.

Our Offices

Contact us

Contact us if you would like to know more about our services or to book your free telephone or video consultation.

Subscribe for latest updates

Membership and Accreditation